You shattered the glass ceiling. Your company is a champion of female representation – a diversity and inclusion dream come true. Yet, amidst the celebration, a disquieting thought arises: are these women achieving true financial equality?

The traditional narrative of financial empowerment often focuses on simple participation – more bodies in seats. But beneath the shiny veneer lies a more intricate story, woven from the invisible threads of social norms. These deeply ingrained societal expectations, from childcare pressures to outdated gender roles, can significantly impact how your employees manage their money. The result? A workforce potentially teetering on the edge of financial insecurity, despite their presence in the office.

Here's where Environmental, Social, and Governance (ESG) factors step in, offering a powerful framework to rewrite the narrative. By focusing on the "Social" pillar of ESG, we can move beyond mere participation and unlock true financial wellbeing for your most valuable asset – your people.

Social and Gender Norms

We've witnessed an increase in women's participation in the workforce and leadership roles. But beneath the surface lies a more complex reality. Deeply ingrained gender norms continue to impact financial behavior and career advancement.

Social norms are the shared beliefs about what's expected and appropriate behavior. They influence how people behave and limit opportunities, particularly for women.

Gender norms define socially acceptable behaviors and roles for men and women. These norms can impact everything from career choices to childcare responsibilities.

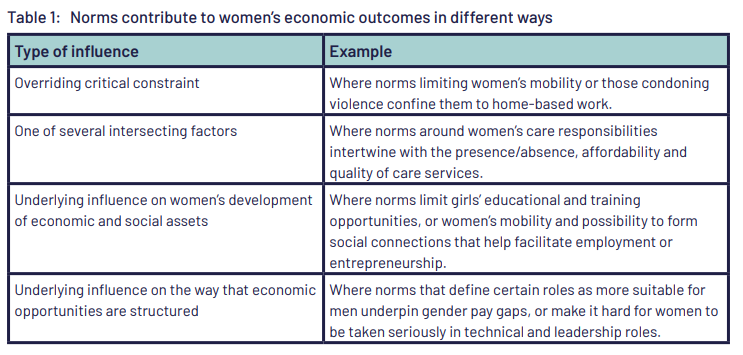

Examples of Gender Norms Affecting Women's Economic Empowerment

- Unpaid Care Work: Women disproportionately shoulder the burden of unpaid childcare and housework, limiting their time for paid work and career advancement.

- Control of Resources and Economic Decision-Making: Men are often seen as the primary breadwinners, giving them more control over financial resources and decision-making.

- Gender-Based Violence: The fear of harassment or violence can deter women from pursuing certain careers or working certain hours.

Social Norms and Financial Wellbeing

Social norms, those unspoken rules that govern our behavior, act as a silent architect, shaping our financial landscape in profound ways. These shared beliefs about what's "expected" can have a powerful and often surprising influence on our financial decisions.

Consider childcare norms. For many women, societal expectations can make it difficult to work full-time, directly impacting their financial security. Research reinforces this idea, highlighting how social norms can even sway our preferences for financial products. Studies show individuals exposed to positive messaging about life annuities, framed as a "common" choice, become more interested in them.

But social norms' influence goes beyond simple messaging. Factors like our mood, susceptibility to peer pressure, and even our childhood financial experiences can intertwine with social norms to create a complex web influencing our financial behavior.

For women globally, restrictive social norms can become significant barriers to financial inclusion. Cultural limitations on mobility or ingrained beliefs about women's capabilities might prevent them from independently accessing mobile banking services.

Women's Economic Empowerment at Risk: Global Gender Gap Report Warns of Post-Pandemic Setbacks

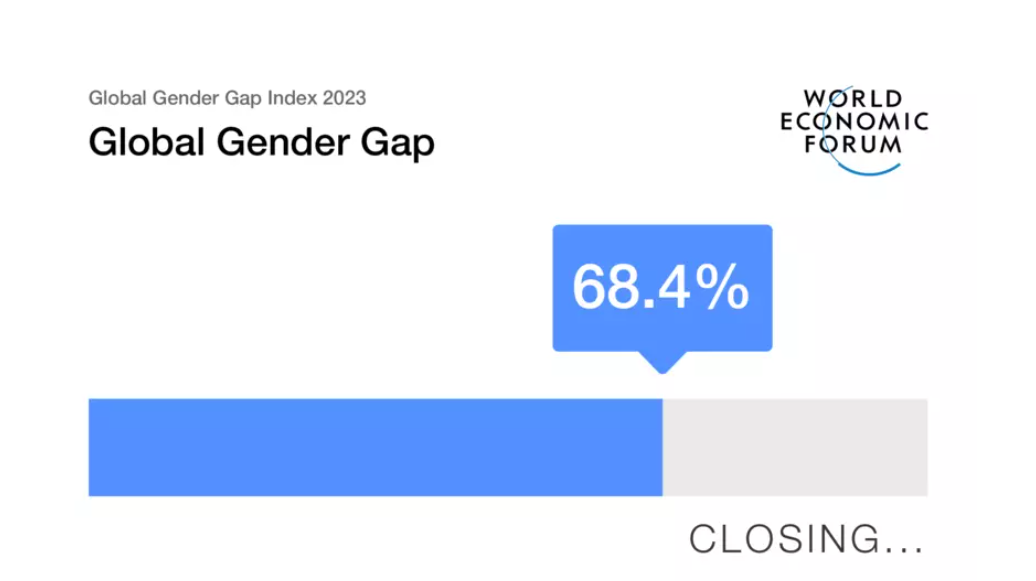

The Global Gender Gap Report 2023 by the World Economic Forum reveals a concerning trend of stalled progress in achieving gender parity globally.

The report estimates that it could take 131 years for women to attain parity with men, not until 2154.

Despite some improvements in educational attainment and health and survival, there has been a slowdown in closing the gender gap in economic participation and political empowerment. The report highlights that the economic participation gap has shown regression, indicating a post-pandemic crisis that risks further setbacks in women's economic empowerment.

Moreover, the report emphasizes that only nine countries have closed at least 80% of their gender gap, with Iceland leading as the most gender-equal country for the 14th year. The United States ranks 43rd with a parity score of 74.8%, showing a decline from the previous year due to a sharp drop in political empowerment index.

The Global Gender Gap Report underscores the urgent need for renewed and concerted action to address these disparities, as achieving gender equality is not only essential for women's advancement but also crucial for economic growth, innovation, and societal resilience.

The Broken Rung: A Hidden Barrier to Women's Financial Wellbeing

Think of a career ladder, each rung representing a step towards higher positions and salaries. Now, picture a broken rung specifically at the transition to management. This, unfortunately, is the reality for many women in the workforce, facing a phenomenon known as the "broken rung."

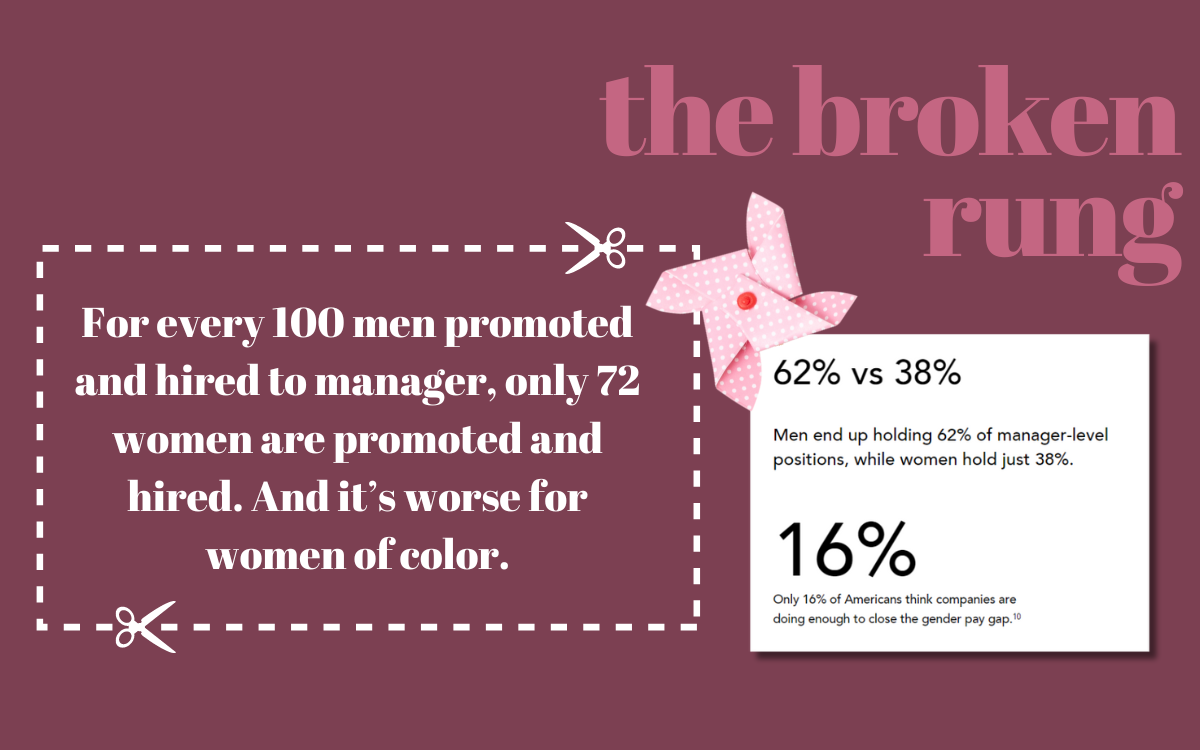

The "broken rung" refers to the significant barrier women face at the first step from entry-level to manager positions, hindering their career advancement and contributing to the gender pay gap. This issue disproportionately affects women, especially women of color, who miss out on critical early-stage promotions, leading to a lack of representation in higher-level positions

The phenomenon is more detrimental to women's advancement than the glass ceiling, as it starts early in their careers and continues to impede their progress at every stage. Women are often promoted based on their track record rather than potential, which can be challenging for those new to the workforce. This systemic bias results in men holding 60% of manager-level positions in companies, further exacerbating the lack of female representation in senior roles

The Detrimental Effects on Women's Financial Well-Being:

Limited Earning Potential: Promotions often lead to substantial salary increases. When women are unfairly blocked from reaching management levels, their earning potential remains stagnant, widening the gender pay gap. This gap can have a cascading effect, impacting their ability to save for retirement, invest in their future, and build financial security.

Loss of Long-Term Benefits: Management positions often come with additional benefits beyond salary, such as bonuses or stock options. When women are stuck below this rung, they miss out on these valuable financial tools that can significantly contribute to their long-term financial well-being.

Career Stagnation and Demotivation: The broken rung can lead to feelings of stagnation and demotivation for talented women. They may see their male counterparts progressing while their own careers stall, impacting their overall morale and potentially leading to reduced productivity or even a switch to a less demanding (and often lower paying) position.

ESG: A Holistic Approach to Financial Equity

For decades, financial decisions have primarily focused on a company's bottom line. While profitability remains crucial, a new wave of investors and stakeholders are demanding a more comprehensive approach – Environmental, Social, and Governance (ESG) investing. Environmental, Social, and Governance (ESG) factors play a crucial role in shaping companies' practices and their impact on financial equity. Here's an elaboration on how ESG contributes to financial stability

Social Responsibility and ESG

Companies that prioritize Diversity, Equity, and Inclusion (DEI) initiatives create a more equitable environment for employees, especially women, fostering equal opportunities for career advancement and leadership roles. This leads to increased earning potential.

Employee Financial Wellbeing and ESG

The Financial Stress Impact

Employees facing financial stress may resort to borrowing from loan sharks due to inadequate reserves, impacting their overall financial wellness. This can lead to a vicious cycle of debt and financial insecurity, which can negatively affect their productivity and overall wellbeing. By addressing financial stress, companies can create a more stable and productive workforce.

Investing in employee wellbeing programs empowers employees to make informed financial decisions and manage stress effectively. Financial literacy workshops empower employees to make informed financial decisions, which is crucial for building financial security.

Mental health support is also vital, as stress can significantly impact an individual's financial wellbeing. By addressing mental health concerns, companies can help employees manage stress effectively and make better financial decisions.

Offering Salary On-Demand can help employees manage unforeseen expenses without falling into debt cycles, enhancing financial security and productivity. Salary On-Demand allows employees to access a percentage of their earned wages in the middle of their pay cycle, providing a viable alternative to payday loans with high interest rates and lengthy repayment periods. This can help employees avoid falling into debt traps and improve their overall financial wellbeing.

Transparent pay structures and clear promotion processes are also crucial for ensuring fairness and reducing unconscious bias in the workplace. By promoting transparency and good governance practices, companies can achieve more equitable financial outcomes for all employees.

The next generation of employees' values ESG principles, with CEOs recognizing that ESG programs improve financial performance and contribute to social welfare. Incorporating a gender lens into ESG investments is another way to promote financial wellbeing for women. This can be achieved by investing in women-owned enterprises (WOEs) and supporting sectors that predominantly employ women. Gender bonds, which focus on WOEs, are a growing trend in ESG investing and address the G pillar of ESG investing.

ESG integration is becoming increasingly vital for financial services organizations. Instead of focusing on isolated elements of ESG, a holistic approach is necessary to address stakeholder expectations effectively. This involves integrating ESG considerations into core business strategies, addressing risks like climate change, and ensuring alignment across the entire workforce.

In the investment industry, there is a growing emphasis on incorporating ESG criteria into decision-making processes. Companies with strong ESG practices tend to have lower risk, better operational performance, and improved share price performance over the long term. Responsible investing is gaining traction among investors, with a significant focus on environmental, social, and governance factors for better investment outcomes.

Equipping Employees with Financial Knowledge

Wellics offers a comprehensive library of educational content and resources on various topics. This content can be seamlessly integrated into existing financial literacy programs or serve as a foundation for companies building new programs to address employee financial stress, a major factor impacting productivity and overall well-being.

Data-Driven Insights for Targeted Support

Wellics goes beyond simply offering resources. The platform provides anonymized data on employee wellbeing trends within a company. This data is invaluable for companies striving to achieve gender equity. By identifying areas where women face specific financial challenges, companies can tailor programs and resources more effectively.

Supporting Diversity, Equity, and Inclusion

Financial literacy is a crucial pillar of Diversity, Equity, and Inclusion (DEI) initiatives. Wellics can play a significant role by offering content and coaching specifically targeted towards women's financial needs and challenges. This could encompass topics like managing finances during maternity leave, negotiating salaries in male-dominated fields, or planning for retirement with potential career gaps due to childcare responsibilities.

Strengthening a Company's ESG Profile

A partnership with Wellics allows companies to go beyond simply stating a commitment to ESG principles. By offering a tangible benefit that directly improves employee financial well-being, particularly for women, companies demonstrate their commitment to the "Social" pillar of ESG.

Furthermore, Wellics' data-driven approach allows companies to track the impact of their financial wellness programs. This data can showcase a measurable improvement in employee well-being, potentially linked to increased productivity or reduced absenteeism. These positive outcomes further strengthen a company's overall ESG profile and demonstrate the value proposition of prioritizing employee financial security.

Investing in a Sustainable Future

Ultimately, by contributing to a more financially secure workforce, companies partnering with Wellics contribute to a more sustainable and equitable future. This aligns perfectly with core ESG values. Wellics empowers women, strengthens the social fabric of the workplace, and fosters a financially healthy workforce – all essential components of a sustainable future for businesses and society.

If you're interested in learning more about how Wellics can empower your workforce and strengthen your overall ESG efforts, we invite you to take the next step. We offer a complimentary employee wellbeing evaluation for your company. Let's work together to build a sustainable future – request your free evaluation today!

Sources:

- https://www.tiaa.org/content/dam/tiaa/institute/pdf/insights-report/2020-06/ti-colbyshu-june2020-01b-0.pdf

- https://www.cgap.org/blog/how-social-norms-affect-womens-financial-inclusion

- https://onlinelibrary.wiley.com/doi/full/10.1111/fare.12959

- https://www.mckinsey.com/featured-insights/diversity-and-inclusion/women-in-the-workplace

- https://fortune.com/2023/10/05/glass-ceiling-broken-rung-women-workplace-mckinsey/

- https://www.mckinsey.com/industries/financial-services/our-insights/closing-the-gender-and-race-gaps-in-north-american-financial-services

- https://leanin.org/women-in-the-workplace/2019/glass-ceiling-and-the-broken-rung

- https://www.alignplatform.org/sites/default/files/2024-01/align_-_report-wee-digital.pdf

- https://www.weforum.org/publications/global-gender-gap-report-2023/

- https://www2.deloitte.com/hu/en/pages/energy-and-resources/articles/esg-explained-1-what-is-esg.html

- https://www.minterellison.com/articles/why-financial-services-needs-a-holistic-approach-to-managing-esg

- https://getcandidly.com/why-financial-wellness-benefits-are-part-of-the-gender-equality-equation/

- https://www.schroders.com/en-us/us/institutional/insights/why-tackling-gender-inequality-is-key-to-delivering-real-financial-inclusion/